Strap in! The fight against dirty banks heats up

Some big wins, and some big campaigns launching!

The next phase of the climate fight is going to center on the big banks that fund the fossil fuel industry. It’s going to be big, loud, and important—and there are signs this week that it’s already starting to be effective.

Climate activists have been taking on the banks for a long time, of course. In the midst of the Dakota Access Pipeline battle, centered on Standing Rock, indigenous activists like Rachel Heaton and Matt Remle launched Mazaska Talks—Mazaska is “money” in Lakota, and they helped battle banks like Wells-Fargo that were funding DAPL and other projects. And of course they drew on work that went back much farther—15 years ago or more indigenous activists in Canada, like Melina Laboucan-Massimo or Clayton Thomas-Muller were traveling to Europe to try and talk banks out of financing the Mordor-scale destruction of the Alberta landscape. Efforts at a broader push have continued since—Stop the Money Pipeline became an effective coalition of groups pushing on the big banks (and asset managers and insurance companies), and there have been many other diverse efforts.

But the pandemic got in the way of mass protests and civil disobedience; and the banks tried to buy some time with the formation of the Glasgow Financial Alliance for Net Zero at the climate talks in Scotland a little more than a year ago. That GFANZ effort has turned into a greenwashing debacle, however—as Bloomberg reported last week, two of its key members, Citibank and Bank of America, “have done more to support the expansion of fossil-fuel companies than any other lenders.” Those two, along with Chase and Wells-Fargo, are the four biggest lenders to the fossil fuel industry.

And so efforts are mounting to hold them accountable—the demand, across civil society, is that they cease funding the expansion of the fossil fuel enterprise. This is hardly a radical demand; it concedes that we’ll be using oil and gas for some years to come (thanks to three-decade denial campaign by the fossil fuel industry) and asks only that it stop expanding: no new pipelines, no more searching for new oil and gas fields. Again, this is not a radical demand: it’s what climate scientists have said must happen. The International Energy Agency (a group of oil importers formed by Henry Kissinger in reaction to the 1970s oil shocks) said in 2021 that expansion would have to cease that year if we were to have any hope of reaching our climate targets. And yet the banks have just gone on lending.

So this morning the Make My Money Matter campaign in the UK launched a high-profile drive to get Brits to move their money out of the “high street banks” that lend to the fossil fuel industry. They’ve got Emma Thompson, Stephen Fry, and other celebs out in front; it got big coverage this morning in the Times of London and elsewhere.

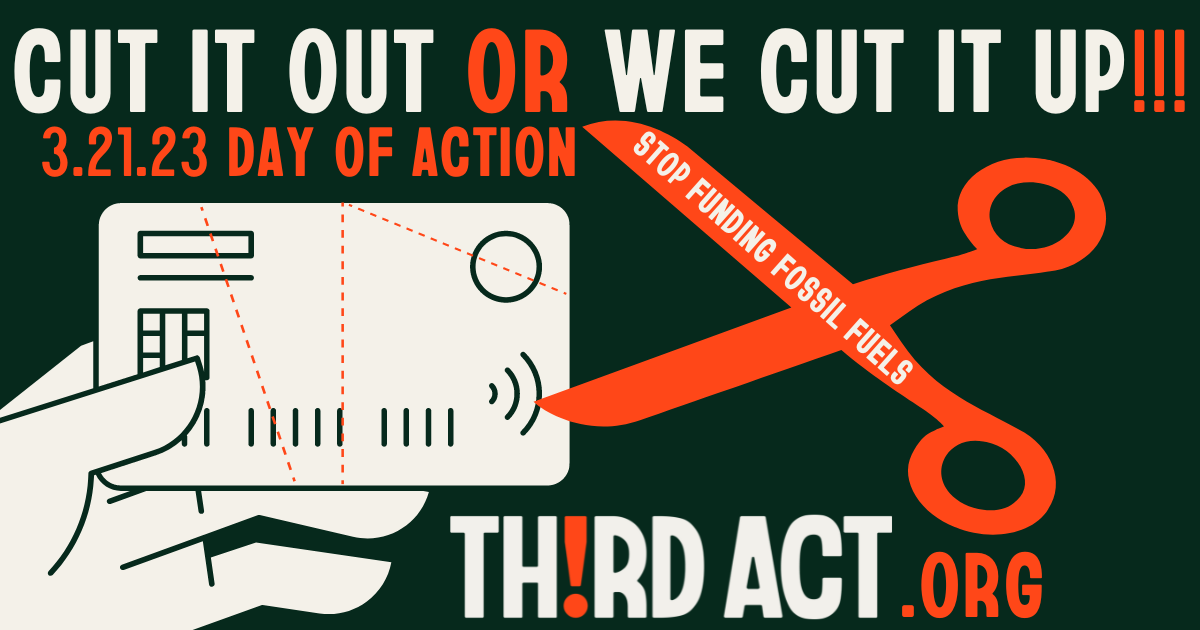

And tonight campaigners in the American Stop Dirty Banks campaign unveil a map of the protests already planned outside banks for March 21 (32123 for the palindromically inclined). The effort’s being coordinated by Third Act, but it includes a huge variety of environmental justice groups large and small, from Greenfaith and Elders Climate Action to the mighty Sierra Club. Indeed, the Club’s new executive director Ben Jealous, who formerly headed the NAACP, provided a forceful reminder on tonight’s call that these were the same banks who enforced seregation’s ‘redlining’ policies in the last century.

“We’ve got to be sure that the banks get the message that the people of this country are increasingly outraged that these big banks were willing to magnify the power of Big Oil and Big Gas,” he said—citing Desmond Tutu’s anti-apartheid campaigns, which leveraged protest against American banking giants as another precedent.

Just to whet your appetite:

Anyway, that message is starting to get through. Other bankers—like Kat Taylor, who runs Beneficial State Bank in California—are now eloquently calling out the giants.

When you get right down to it, your mundane local suburban branch of the Big 4 banks might as well have a smokestack on its roof. Yes, they also invest in wind and solar (and boast about it endlessly in their ads). But that doesn’t negate the damage that comes from expanding the size of the fossil fuel empire.

And a series of huge wins in Europe in recent days point out the possibilities

#In mid-December, HSBC, biggest bank in Europe by assets, announced it was ending lending for new oil and gas fields—that’s not everything we need, but they were the first of the really big boys to concede that they’d have to change.

#Yesterday the Danish banking giant Danske announced more sweeping policies (it’s worth reading the corporate pledge, which in some respects is quite impressive).

#And then later in the day the largest pension fund in Europe, ABP, announced that it was “putting banks on notice and may start exiting the sector unless it sees proof that claims of portfolio decarbonization are matched by action.”

That momentum came with an American twist too. New York City’s comptroller, Brad Lander, called on the big banks in this country to follow suit and produce serious policies to cut emissions fast. “We expect them to take the steps needed now to reduce emissions on the timeline to which they have committed,” Lander said. That’s no empty threat—New York City’s pensions are a quarter of a trillion dollars in size, and Lander controls the myriad banking arrangements for the city. Oh, and today House Democrats launched a “Sustainable Investment Caucus” to push back against red-state treasurers trying to stop so-called “ESG” investing.

None of this means the fight will be easy: these banks, after all, represent the capital in capitalism. But the fight is being fully engaged now, and 32123 will be a big step up: I’m hearing of plans for sit-ins at banks across the country (some of the sitting-in to be done on rocking chairs, since some of us are old), and people planning to cut up credit cards underwater against a backdrop of dying coral reefs or on land scarred by our recent massive forest fires.

Some people have been pledging to close accounts at these banks, which is powerful (and here’s one resource for finding a greener bank)—but it’s not a requirement. Even more than direct financial damage, we need to damage the reputation of these banks, so that people understand just how dirty they currently are. Peacefully, of course, but also forcefully. These bankers are literally mortgaging the future of the earth.

Please join in! Again, here’s the place to schedule an event for March 21, no matter how big or small!

Other climate and energy news (since I sent out another newsletter yesterday, not much has accumulated!)

+Using Ithaca New York as an example, the American Prospect reports on the logistical and financial obstacles that will have to be overcome if we’re to actually electrify America

The financial industry is eyeing the emergence of clean energy-as-a-service, where profit margins are slim for now but agreements could last in perpetuity. Ithaca is an early case study of how, due to the design of the IRA, the ambitions of the green-energy transition rest on deals between building owners, small cities, and Wall Street, the terms of which are only beginning to be negotiated.

+We’re moving, blessedly, from hot takes on gas stoves to long and detailed pieces. Here’s Sandra Steingraber and if you’d rather listen to something, here’s Dave Roberts’ podcast