What You Want is an S Curve

And we're finally hitting the sweet spot of the crucial one

Regular readers of this column know that I think we’re engaged in the most desperate race in human history—a race between a rapidly unraveling climate, and a rapid buildout of renewable energy. The outcome of that race will determine just how many people die, how many cities drown, how many species survive. Pretty much everything else—efforts to restore corals, say, or worries about how exactly we’ll power long-haul aircraft—is noise at the margins; the decisive question is how those two curves, of destruction and construction, will cross. Oh, and the relevant time frame is the next half-decade, the last five or six “crucial years.”

So even amidst all the desperate news from climate science, I have some legitimately good numbers to update you on this morning. They come from the veteran energy analyst Kingsmill Bond and colleagues at the Rocky Mountain Institute, and they demonstrate that the world has moved on to the steep part of the S curve, which will sweep us from minimal reliance on renewable energy to—we must hope and pray— minimal dependence on fossil fuel. The angle of that curve may prove to be the most significant geometry of our time on earth, competing only with the slope of the Keeling Curve which documents the growing accumulation of co2 in the atmosphere above Mauna Loa.

It seems pretty clear, according to Bond’s team, that last year or this we will hit peak fossil fuel demand on this planet—the advent of cheap solar and wind and batteries, combined with rapidly developing technologies like heat pumps and EVs, has finally caught up with the surging human demand for energy even as more Asian economies enter periods of rapid growth: the question is whether we’ll plateau out at current levels of fossil fuel use for a decade or more, or whether we can make fossil fuel use decline enough to begin to matter to the atmosphere.

And the numbers in the new report give at least some reason for hope: sun and wind are now growing faster than any other energy sources in history, and they are coming online faster that anyone had predicted, even in the last few years. In the last decade, “solar generation has grown 12 times, battery storage by 180 times, and EV sales by 100 times.” This charge has been led by China, where “solar generation up 37 times and EV sales up 700 time.” and which as a result is “poised to be the first major electrostate.” Europe, and indeed the whole OECD group, are now seeing rapid growth too, and the best news is that there are increasing signs that countries like India and Vietnam, where growth in demand will be fastest over the rest of the decade, are figuring out how to electrify their economies. Fossil fuel for generating electricity has peaked in Thailand, South Africa, and in all of Latin America.

Solar power in particular is about to become the most common way to produce electricity on this planet, and batteries will this year pass pumped-hydro as the biggest source of energy storage; the supply chain seems to be in place to continue this kind of hectic growth, as there are enough factories under construction to produce the stuff we need, and investment capital is increasingly underwriting cleantech (though a treacherously large supply of money continues to flow to fossil fuels). Pick your metric—the number of cleantech patents, the energy density of batteries, the size of wind turbine rotors—and we’re seeing rapid and continuing progress; the price of solar power is expected to drop by half again in the course of the decade, reinforcing all these trends. The adoption curves for cleantech look like the adoption curves for color tv, or cellphones—that is to say, from nothing to ubiquitous in a matter of years.

A big reason for the ongoing change—and for ongoing optimism—is the simple efficiency of the technologies now ascendant. A second report from Bond’s Rocky Mountain Institute, this one published last week, focused on these numbers, and they’re equally astounding. By their calculations, we waste more than half of the energy we use:

Out of the 606 EJ (an exajoule is roughly the annual energy consumption of New York City) of primary energy that entered the global energy system in 2019, some 33% (196 EJ) was lost on the supply side due to energy production and transportation losses before it ever reached a consumer. Another 30% (183 EJ) was lost on the demand side turning final energy into useful energy. That means that of the 606 EJ we put into our energy system per annum, only 227 EJ ended up providing useful energy, like heating a home or moving a truck. That is only 37% efficient overall.

We’ve invested mostly in increasing the volume of energy we use, not its efficiency—because that was what made big money for Big Oil. But cleantech is inherently more efficient: when you burn fossil fuel to make power, you lose two-thirds of the power to heat, which simply doesn’t happen with wind and sun. An EV translates 80-90% of the power it uses into propulsion, compared with well less than half for a car that runs on gas. A gas boiler is 85 percent efficient, which isn’t bad—but a heat pump is 300% efficient, because its main “fuel source” is the ambient heat of the atmosphere, which it translates into heating and cooling for your home. That means that the higher upfront costs of these technologies quickly translate into serious savings. And these kind of numbers bend curves fast

The rapid uptake of these technologies can be a key driver of more demand-side efficiency gains as well. Installing a new heat pump is the perfect time for households to consider additional building envelope retrofits such as insulation: enough insulation can shrink if not eliminate the heat pump. When engineers design new EVs, better aerodynamics and lightweighting are essential to improve range and save batteries. As an industrial site undergoes a major retrofit to switch to heat pumps, new pipe designs with less friction (fatter, straighter pipes) or other more efficient process designs can be implemented. The exponential uptake of renewables, localization, and electrification hence also means an exponential increase in potential intervention moments for designers and end users to consider demand-side efficiency opportunities

Just to give an example, the EV maker Rivian—which only produced its first models three years ago—last week announced a redesign, which will remove 1.6 miles of wiring from each vehicle. That’s among other things a lot less copper—and indeed the price of copper has remained relative stable even as electrification proceeds.

Oh, and by the way, if someone tries to tell you that the conversion to clean energy is the reason for increases in the price of electricity, they’re wrong. As Fatih Birol, the head of the International Energy Agency just pointed out in a new report,

The global energy crisis that escalated in early 2022 was not caused by clean energy. Since the early days of the crisis, I have been speaking regularly with energy policy makers from around the world. None of them have complained of relying too much on clean energy. On the contrary, they wish they had more, because the result of investing in these technologies today is a more affordable energy system for consumers tomorrow – as well as less severe impacts from climate change, major improvements in air quality and greater energy security. When people misleadingly blame clean energy and climate policies for the recent spikes in energy prices, they are, intentionally or not, moving the spotlight away from the main cause – the major cuts that Russia made to natural gas supply.

The numbers I’ve been outlining here are splendidly hopeful. They’re they’re the signs that human intelligence, as encoded in solar panel design and battery development, can combine with human practicality, as encoded in economics and policy, to produce real change.

But our species has other qualities—human greed being a prominent one, and that greed can shade over into sociopathy as we’ve seen from too many world leaders of late. In this case that greed is exemplified in the fossil fuel industry, which will not give up its business model without a tenacious fight; when we were busily converting to color television there was not a giant industry pulling out every trick to stop us making that choice. (Just the opposite). That greed could fatally slow down the cleantech side of this race, giving the victory to unchecked global heating. That’s why this year is so important—if we join with Big Oil and elect Trump, and people like him in the other elections underway around the planet, they can slow this transition markedly. If we had fifty years to make this transition that would not matter—sheer economics make it eventually inevitable. But ‘eventually’ does us no good if the global ice sheets have collapsed in the meantime, or the Gulf Stream shut down, or the Amazon turned to savanna. To make this remarkable moment matter we have to move fast.

2030 is, I’ve long thought, the relevant deadline. And so back to that IEA report, which gives us the play by play on the race. As Fiona Harvey summarizes in the Guardian:

Countries agreed last December on a tripling of renewable power by the end of this decade. But few have yet taken concrete steps to meet this requirement and on current policies and trends global renewable generation capacity would only roughly double in developed countries, and slightly more than double globally by 2030, according to an analysis by the International Energy Agency.

I’m going to go over those numbers once more. At the moment, we’re on a path to double renewable power by the end of the decade. That’s great. But we need to triple renewable power by the end of the decade to meet even the modest targets we set at Paris for holding the temperature in check. That gap likely defines the human future. If we meet the challenge, we may have survivable trouble to deal with. If we don’t—well, let’s meet it. That’s our work together in the crucial years, and keep tuned here for more in the months ahead about how we’re going to make it happen.

You can get a sense of the tensions in, say, the latest data from the U.S. solar industry, which shows utility scale solar continuing to accelerate, but residential solar slowing down, as government policy (especially California’s incomprehensible decision to restrict its development) begins to kick in. (Here’s some more data from the invaluable Michael Thomas on the rise of the clean-energy megaproject in the U.S.) We have no time for these kinds of stop-start policies—we must (and I realize this is the most internal combustion metaphor ever) go full gas/no brakes.

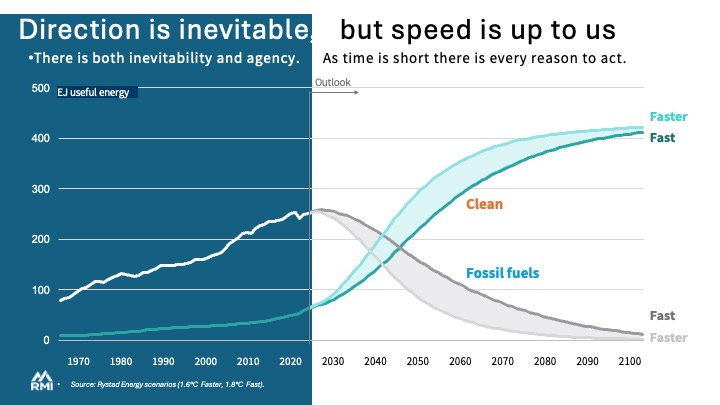

Here’s a graphic representation from the RMI study, and it’s worth scrutinizing. The difference between ‘fast’ and ‘faster’ is what I’ve been describing—the shaded areas between them may well be the most important shade on an ever-warmer earth.

In other energy and climate news:

+Another crucial new report out today, this one not so merry. It shows that the big banks—save for HSBC—continue to lend to projects ravaging the Amazon and the people who have made their homes there for eons. It comes from Stand.Earth

This report examines how the environmental and social risk management (ESRM) policies of the top banks financing oil and gas extraction in Amazonia fail to fully address the adverse impacts of their financing on people and nature. Over the past 20 years, just six banks – Citibank, JPMorgan Chase, Itaú Unibanco, Santander, Bank of America, and HSBC – are responsible for almost half (46%) of all direct financing for oil and gas operations in Amazonia.

Most of these banks claim to uphold human rights and environmental protection, but, with the exception of HSBC, they continue to finance the operations of state-owned and private oil and gas companies in Brazil, Peru, Colombia, and Ecuador. And yet, banks make claims on their websites, reports, and promotional materials that give the impression that they are finding success in protecting the environment and safeguarding human rights through their due diligence processes. This analysis indicates that banks are greenwashing their contribution to adverse impacts in Amazonia. While their stated commitments to addressing climate change, biodiversity loss, and the exploitation of Indigenous Peoples create the perception that they are protecting people and nature, the banks continue to finance destructive operations.

ESRM policies that do not net out some of the dirtiest and most destructive fossil fuel development are failing to respond to the climate crisis at a time when the science is clear that any new fossil fuel projects threaten our ability to ensure a stable future. Amazonia is the most biodiverse region on Earth and home to more than 500 distinct Indigenous Peoples, but, on average, over half of Amazonia (59%) is not adequately considered in the ESRM frameworks of Amazonia’s top oil and gas financiers. When HSBC’s Amazonia exclusions are removed, the other top 5 banks in the study cover an average of just 4% of Amazonia with exclusions and another 25% with screens. That leaves an average of 71% of Amazonia with no risk management for climate change, biodiversity, forest cover, and Indigenous Peoples rights.

+Tasneem Essop, the remarkable head of Climate Action Network International, and Elizabeth Bast of Oil Change International, argue persuasively that it’s time for an actual and serious transfer of funds from the countries that have gotten rich damaging the climate to the countries in desperate need of clean energy

Rather than relying on the private sector, rich countries can afford the grants and highly concessional finance required for a fast, fair and full phase-out of fossil fuels, which societies and communities want. There is no shortage of public money available to fund climate action at home and abroad. Rather, a lot of it is currently going to the wrong things, like dirty fossil fuels, wars and the super-rich.

The lack of progress is also a symptom of a larger global financial system where a handful of Global North governments and corporations have near-full control. This unjust architecture results in a net $2 trillion a year outflow from low-income countries to high-income countries, historic levels of inequality and food insecurity, and record profits for oil and gas companies.

To raise the funds, wealthy governments can start by cutting off the flow of public money to fossil fuels and making polluters pay. The science is clear that there is no room for any new investments in oil, gas or coal infrastructure if we want to secure a liveable planet. And yet governments continue to pour more fuel on the fire, using public money to fund continued fossil fuel expansion to the tune of $1.7 trillion in 2022.

I think there’s little question this is emerging as the most important question for international climate talks—it will dominate this year’s COP in Baku, at least among the attendants who aren’t lobbyists for oil companies. It’s the last crucial piece in the transformative puzzle I was outlining in the main part of this week’s newsletter.

+A superb project from Public Citizen and veteran campaigner Clara Vondrich looks at the survivors of climate disasters. They offered testimony at a conference last week, and this was typical:

“I’ve lived in Arizona forever and it’s always been hot but not like this. That’s what scares me most. It just keeps getting more and more severe, unlivable really. If you leave your car in the heat even for 10 mins, you can burn your hands on the steering wheel, and you definitely can’t wear shorts in the summer – the seat will burn you and the seat belt buckle will sizzle your skin. When we go grocery shopping we have to buy ice and keep a Cooler in the back of the car so the food won’t spoil. we Always have to have ice water because If car gets a flat tire, it’s not safe. We could die..” — Deborah Parker, survivor of extreme heat in Tucson, AZ

+IEEFA’s Ramnath Iyer finds that, all the dust kicked up by red state treasurers and culture warriors to the contrary, ESG investing is doing just fine

In 2023, as per independent fund investment research house Morningstar, sustainable funds had a median return of 12.6% versus 8.6% for traditional funds. This outperformance extended across equity and fixed-income funds asset classes.

Europe, the most advanced regionally in embracing sustainable funds, saw an inflow of almost US$11 billion into this asset class in the quarter ended March 2024. In contrast, ESG investing appears politicized in the United States and is seeing outflows.

+A cool tool from Project Innerspace lets people see the geothermal potential wherever they live

+Fund giant Vanguard disclosed that it voted its shares to re-elect Exxon’s directors last month, despite the fact that the company was suing fellow shareholders who tried to influence its policy.

"While the company's decision to continue to pursue the lawsuit gives us some pause given the potential chilling effect on future shareholder proposals, we do not, at this time, see evidence that the (Exxon) board has overseen actions that have negatively impacted shareholder returns," Vanguard wrote.

As opposed to negatively impacting the Thwaites ice sheet…

+Mexico elected Claudia Sheinbaum, an energy expert, president last week. That’s been hailed as good news by some in the climate community, but Sheinbaum has also been an undeviating acolyte of current president Lopez-Obrador, who whatever his other virtues is an old-school adherent of environmental destruction in the name of economic centralization, bent on restoring the national oil company Pemex to its glory. Sheinbaum defeated another woman, Xochitl Galvez, who had actually staked out a much more pro-environment platform.

The best inside look at Sheinbaum I’ve seen comes from the San Jose Mercury News (via Bruce Hamilton!). Their reporter talked to her former colleagues at Lawrence Berkeley National Laboratory, where she worked for four years in the 1990s. Ashok Gadgil, now a professor of engineering at UC Berkeley, said she

had an intensity of personality and strong scientific curiosity, with a drive to understand the data behind a given issue. This focus extended into creating “serious fact and evidence-based policies,” he said, then asking how these policies influenced the trends in the data.

“That’s a good question to have as a head of state,” Gadgil added.

As she enters a challenging political role, Gadgil predicted that she will not become inflexible or tied to a dogmatic viewpoint as president, but rather base her approach on facts. The “shining” quality of her leadership is her commitment to the scientific method, he added.

+Chicagoans: The always-interesting Brushwood Center has an upcoming evening of music and talk that sounds worth one’s time

This 90-minute bilingual (English and Spanish) performance, guided by Brushwood Center’s Ensemble in Residence, Black Moon Trio, translates the lived experiences of communities in Lake County, IL affected by environmental racism and health inequities through original music, illustration, and storytelling.

This signature concert experience is a collaboration between Black Moon Trio and Brushwood Center featuring original music, two commissioned compositions from composers Marc Mellits and Jerod Impichchaachaaha' Tate, and original artwork from five visual artists across the country.

+Old and reliable friend (and Ukrainian hero) Svitlana Romanko, has a new essay on how Big Oil is managing to finance both Trump’s re-election and Putin’s war. She points out the new evidence clearly linking U.S. oil execs to OPEC efforts to keep the price of oil elevated, and then explains

Today, high oil prices bolster Russian energy exports, funneling billions into the Kremlin’s pockets and effectively underwriting its invasion of Ukraine. This isn’t just poor economics—it’s a direct subsidy for autocracy and violence. By propping up Putin and other petro-dictators, Big Oil is complicit in the suffering inflicted on countless innocent lives in Ukraine and beyond.

Meanwhile, the best efforts of Houston, OPEC, and Putin have been thwarted at least a little by the cagey President Biden and his well-timed efforts with the country’s Strategic Petroleum Reserve

+An important new bill that will play out in next year’s New York State legislative session would try to stop insurance companies from dumping customers in the event of a climate emergency, and also stop them from using premiums to support the same fossil fuel industry that is causing the climate crisis. As Colin Kinniburgh and Julia Rock report,

The New York bill would allow regulators to block insurance companies from dropping customers in the immediate aftermath of a storm. In other cases, insurers would have to give residents at least one year’s notice of a cancellation. The bill also includes a ban on “bluelining” — the practice of systematically denying insurance coverage in areas based on environmental risks like flooding.

Virtually all of the world’s major insurers do business in New York and would be subject to the law, so action in Albany could have substantial implications for fossil fuel projects across the globe.

“Insurance is a very powerful cudgel,” said Brad Hoylman-Sigal, the bill’s Senate sponsor. “If we don’t do this at the state level, I don’t think we’re going to see it happen anywhere else.”

Given last week’s debacle with congestion pricing, it’s unclear how much good progressives can do in sclerotic Albany, but one has to keep trying—and in the middle of the mess, the legislature did follow Vermont’s lead and pass the Climate Superfund bill, which now awaits the signature of Gov. CongestionKathy Hochul

We also need to reframe people’s complaints about how “we foolishly subsidize fossil fuels. That money should be going elsewhere.”

If fossil fuels aren’t subsidized, inflation goes up and calls for revolution fill the air. People replace their political leaders with those who will reinstate the subsidies.

For example, who will Americans vote for if the price of gas goes up a dollar or two per gallon this fall?

You know the answer. And that man will not hesitate to destroy the world with his narcissism — we would survive him only by the momentum we have already generated and luck.

https://www.nytimes.com/2022/11/04/opinion/ezra-klein-podcast-bradford-delong.html

Again, the best thing we can do is ALSO subsidize and mandate the transition to EVs. In particular, I think getting delivery trucks to switch will insulate the costs of shipping from increasing gas prices, which will mitigate inflation. (And the Biden administration has been doing this.)

https://grist.org/regulation/biden-epa-truck-rule-climate-pollution-heavy-duty-bus-delivery/

At some point we’ll be able to cut back on fossil fuel subsidies, because they won’t wreck the economy people rely on to pay down their debts (or fill the profound wells of loneliness they experience with activity and consumption).

I’m following every article I can about the costs of EV semi trucks and the rate of their adoption around the world. The ports of LA & Long Beach receive 40% of American imports, so what happens there is very impactful:

https://polb.com/port-info/news-and-press/construction-begins-on-truck-charging-depot-at-port-05-15-2024/

https://www.washingtonpost.com/climate-solutions/2024/01/18/electric-truck-drivers-vehicles/

This would be good news if renewables were remotely the solution to climate change and ecological overshoot. Put simply, we could achieve a 100% renewable-generated electricity grid and STILL have a massive reliance on fossil fuels. Think fertilisers, pharmaceuticals, shipping, air travel, concrete production, steel production, plastics (I could go on).

Electricity generation itself is only 21.3% of our global energy needs.

No, we have built an entire civilisation on the back of fossil fuels and it will take much more than putting up bunch of solar panels and wind turbines to address the mess that that reliance has caused.